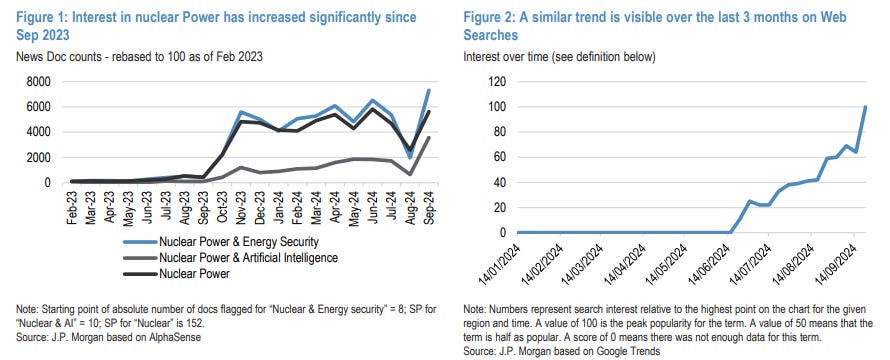

We are currently in the midst of, what, maybe the third or fourth nuclear “renaissance” in the last 40 years? Sounds about right. As such, a third or fourth nuclear revival failure would hardly be an unreasonable base expectation.

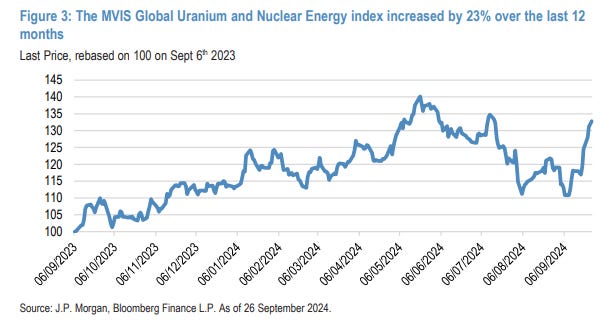

However, there are some pretty strong tailwinds that give cause for optimism, as outlined in a new report from JP Morgan, America’s largest bank.

- ⚛ First, climate change – and the lack of scarcity-driven policy-making – has changed the risk-benefit calculation for many governments. Nuclear power’s ability to generate huge amounts of carbon-free energy is increasingly seen as outweighing all other environmental and safety concerns. “This trend should continue to gain importance going forward, especially as the world fails to stay on a 1.5°C trajectory.” What is the alternative? Degrowth?

- ⚛ Second, energy security has become a much bigger priority since Russia invaded Ukraine. (Here’s looking at you, Germany.)

- ⚛ Third, there is the explosive growth of artificial intelligence and data centers. JPM points out that this exploding techno demand will essentially add another Japan to global electricity demand by 2026. “In particular, this should be a strong component of the projected increase in US electricity demand over the next three years.”

- ⚛ Fourth, mini nuclear reactors or “small modular reactors” can provide an innovative solution to nuclear power’s biggest headache – high costs and slow construction times. SMRs are simpler, factory built, and get real orders, especially from technology companies. Although SMRs won’t hit the market until around 2028 — assuming all goes well with technology and regulations — they could finally be the innovation breakthrough nuclear has been waiting for. Consider this: The world’s current reactor fleet is, on average, 32 years old, according to JPM. Time for an upgrade.

But it is the various headwinds confronting this promising nuclear revival that prompt the name of the JPM report:

From the report:

We believe that the growing interest in civilian nuclear energy is real and can boost investment in nuclear capacity. However, financial market participants should remain aware of the inherent challenges of the nuclear industry to avoid falling into a “NucleHype.”

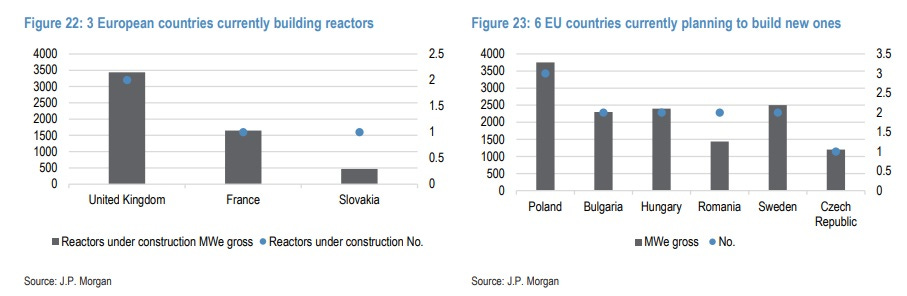

The report is Europe-focused, which makes sense as a growing number of governments are redeploying nuclear power or turning to nuclear power for the first time. But there are plenty of cautionary notes highlighted and explained by JPM that apply to the US, which we will quickly review:

- ☢ Cost and construction challenges. The new Vogtle Units 3 and 4 project in Georgia exemplifies the cost and timeline challenges, according to JPM, running over $30 billion and taking 14-15 years to complete. (However, the US Department of Energy points out that Vogtle Unit 4 was about 30 percent more efficient and 20 percent cheaper to construct than Unit 3, showing significant learning even within a single project.) Without government support, private financing costs can become prohibitive because nuclear power plants have huge upfront costs and take many years to build before generating any revenue. New nuclear construction is particularly challenging in deregulated electricity markets (power producers compete directly instead of having guaranteed prices), where plants must compete with cheaper natural gas and renewables. That said, long-term power purchase contracts from tech companies, like Microsoft’s deal with Constellation Energy for Three Mile Island, could offer a new financing model, JPM suggests.

- ☢ Social and political risks. US public acceptance of nuclear waste has been shaped by historical accidents, particularly TMI. Nuclear waste policy remains contentious, particularly after the Yucca Mountain repository, a proposed permanent storage facility for spent nuclear fuel, was abandoned. But as JPM points out, bipartisan support has grown, evidenced by pro-nuclear provisions in the 2021 Infrastructure Investment and Jobs Act, which included significant funding for advanced reactors and SMRs. (In a recent essay, I argue that nuclear power’s growth depends on public support or societal consent. Fortunately, its value proposition is simple: reliable, clean power—crucial for both current needs and the new AI revolution.)

- ☢ Human capital and knowledge gaps. This is what happens when you stop building. The US nuclear engineering talent pipeline is in dire shape, with degrees awarded hitting their lowest level in a decade. The current median salary for nuclear engineers is $100,000, notes JPM, but competition from tech and AI companies is intensifying the talent war. This brain drain is particularly problematic as the US Navy ages. With North American reactors averaging 42.5 years old – the highest globally – the sector faces challenges in maintaining excellence. The shortage affects both new construction and ongoing work to keep factories running safely, potentially requiring companies to bring back retirees to help scale operations.

- ☢ Supply Chain and geopolitical dependencies. Sure, US uranium mining capacity exists. But production has fallen significantly, making the country dependent on imports. (“Uranium resources are concentrated in a few countries, and uranium enrichment capacities and trade are highly regulated. Thus, nuclear power is not a “geopolitical safe harbor”.) Furthermore, there are currently no new nuclear construction projects captured in the World Nuclear Association reactor database for North America, highlighting the major decline in the domestic supply chain. But the rise of US-based SMR companies like NuScale suggests the potential for supply chain revitalization, according to JPM. Important: The industry needs capabilities across the entire nuclear fuel cycle ( from mining uranium through enrichment, fuel production, use and disposal of waste) to reduce dependence on foreign suppliers.

Bottom line: A nuclear success scenario is one in which a) technology sector purchase agreements provide stable revenue streams and lower financing costs, b) climate advocacy maintains political support even as strong safety records improve public acceptance, c) industry addresses its talent pipeline by offering competitive salaries (nuclear engineers earn one-third more than renewable energy workers) and establish new training programs to address the skills gap, and d) next-generation technology wins out, tech. (Western markets are likely to focus on a mix of reactor life extension, new large reactors and SMR rollouts).

A failure is a scenario in which the revival collapses due to a) continued cost overruns and delays even as renewable energy becomes increasingly cost-competitive, b) a major accident triggers what sociologists call “social amplification of risks” and c) a deepening the talent crisis deepens.

Overall, however, this is a fairly encouraging report that suggests areas of focus for policy makers both here and abroad;